19+ Va mortgage lenders

We can help you understand the benefits of VA loans and empower you on your homeownership journey. Mortgage industry is seeing its first lenders go out of business after a sudden spike in lending rates and the wave of failures thats coming could be the worst since the housing bubble.

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

They are backed by the Department of Veterans Affairs VA and offered by private lenders like Freedom Mortgage.

. COVID-19 Small Business Loans and Assistance. The Cash-Out Refinance Loan can also be used to refinance a non-VA loan into a VA loan. The Department of Veterans Affairs VA Cash-Out Refinance Loan is for homeowners who want to trade equity for cash from their home.

No matter what state you live in youll find licensed lenders in our directory who can work with you on your home purchase or mortgage refinance. Veterans may be eligible for refinancing their VA mortgage using an Interest Rate Reduction Refinancing Loan IRRRL. Please visit the trouble making payments web page if you have financial trouble or some other circumstance regarding your VA home loan.

You may want to refinance your mortgage to take advantage of lower interest rates to change your type of mortgage or for other reasons. This may not apply if you were already behind on your mortgage when the COVID-19 forbearance was requested. Mortgage lenders in every state.

Private Mortgage Insurance PMI 0 to 1. These refinances let you replace your current mortgage with a new VA mortgage for a higher amount and get the difference in cash when you close your new loan. Home equity loans and lines of credit suspended due to COVID-19 are still unavailable.

It may be that your mortgage company has to. On Friday September 16 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed mortgage rate is 6280 with an APR of 6300. These resources will help you learn more about refinancing your mortgage.

NerdWallet has chosen these construction mortgage lenders as standouts. In the US the Federal government created several programs or government sponsored. Save 1440 No Lender Fee.

For mortgage lenders we take into account each companys customer service ratings interest rates loan product availability minimum down payment minimum FICO score and online features. We display lenders based on their location customer reviews and other data supplied by users. Home equity loans and lines of credit suspended due to COVID-19 are still unavailable.

Including FHA VA and USDA. See NerdWallets picks for some of the best interest-only mortgage lenders in 2022. This monthly payment protects the bank against the risk of loan non-payment.

VA loans can help you buy a home refinance a home or get cash from your homes equity to spend on renovations or education. ZGMI a fee to receive consumer contact information like yours. With over fifteen years of experience as home mortgage lenders we are ready to walk clients through everything they need to know from navigating adjustable rate mortgages to applying for FHA financing.

To apply for an FHA-insured loan you will need to use an FHA-approved. Real Estate Agents Mortgage Lenders Hard Money Lenders Insurance Contractors Investment Companies Build Your Team. These loans can be used as strictly cash at closing to payoff debt make home improvements and pay off liens.

VA A VA loan is a mortgage loan available through a program established by the United States Department of Veterans Affairs. ZGMI does not recommend or endorse any lender. During the COVID-19 national emergency however if you were current on your mortgage when the COVID-19 forbearance was granted your mortgage company should report your account as current.

With a VA cash out refinance you might be able to get a new VA mortgage for 175000 plus 50000 in cash. If you are a borrower and want to contact the VA Loan Guaranty Office regarding any aspect of your mortgage please call 1-877-827-3702 with hours of operation from 8am to 6pm EST. Including FHA VA.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. For example pretend your current mortgage balance is 125000. It is only required on a typical conforming mortgage if you pay less than 20 down until you have at least 22 equity in the home or 20 equity and you request the fee removed.

Our comprehensive listings include mortgage lenders and mortgage brokers in all 50 states and the District of Columbia. Refinancing your mortgage allows you to pay off your existing mortgage and take out a new mortgage on new terms. Fellowship Home Lenders offer clients multiple choices whether they are purchasing or refinancing a home.

Participating lenders may pay Zillow Group Marketplace Inc. It insures mortgage loans from FHA-approved lenders against default.

Jordan Points Mortgage Loan Officer Certainty Home Loans Linkedin

Jordan Points Mortgage Loan Officer Certainty Home Loans Linkedin

Dave Cotner Licensed Mortgage Loan Officer

June 19 2013 By Cowichan Valley Citizen Issuu

Jordan Points Mortgage Loan Officer Certainty Home Loans Linkedin

2

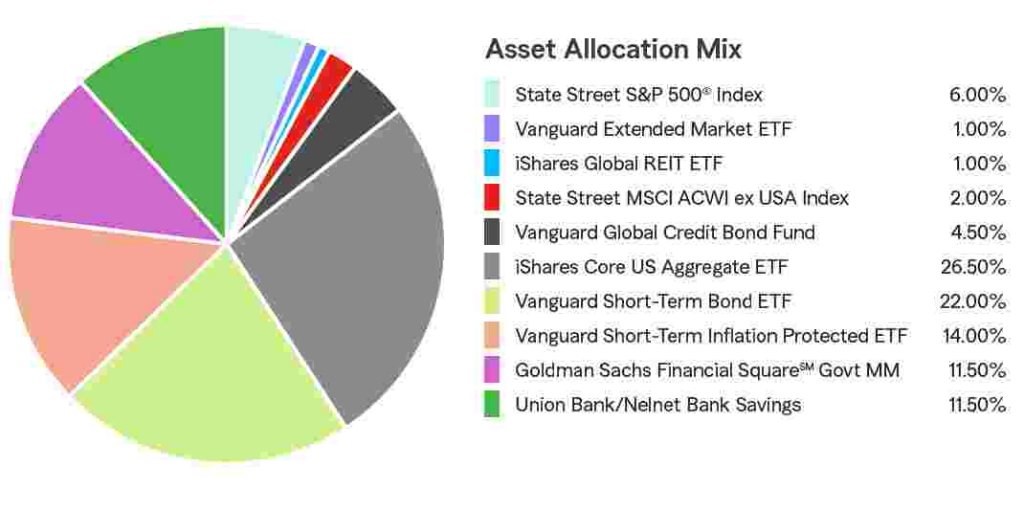

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

House Construction Schedule For Owner Builders Home Construction Build Your Own House Home Building Design

Brentwoodpress 12 27 19 By Brentwood Press Publishing Issuu

Free 11 Mortgage Broker Business Plan Samples In Google Docs Ms Word Pages Pdf

Real Estate Exam Cheat Sheet Real Estate Exam Real Estate Test Real Estate Tips

Dave Cotner Licensed Mortgage Loan Officer

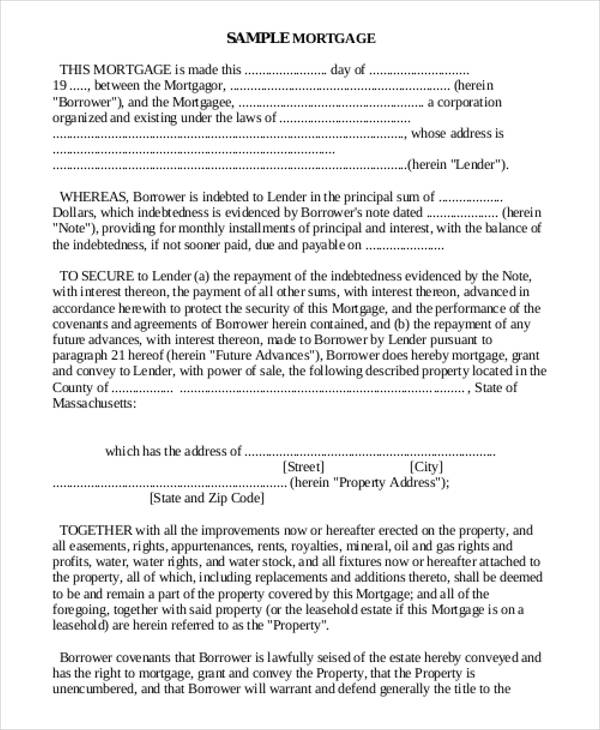

6 Mortgage Contract Templates Free Sample Example Format Download Free Premium Templates

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

Construction Timeline Family House Plans Building A House New House Construction

Loan Payment Schedule Amortization Schedule Loan Repayment Schedule Schedule Template

Best Mortgage Rates In California Best Mortgage Rates In Ca