401k deduction calculator

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Ohio and.

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

This first calculator shows how your balance grows during your working years.

. And the amount of contribution for himself to the plan. Once you have 250000 or more in total plan value add up all your assets and cash in the plan you will file form 5500-EZ. Elective Deferrals401k etc Payroll Taxes Taxes Rate Annual Max Prior YTD CP.

Moving expenses for a job. A 401k is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Contributions to a retirement account 401k IRA Health savings account deduction.

College tuition and fees. Enter your total 401k retirement contributions for 2021. The Colorado tax calculator is updated for the 202223 tax year.

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. For 2021 you can. You only pay taxes on contributions and earnings when the money is withdrawn.

A Solo 401k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan. Click the Customize button above to learn more. Withdrawing an amount that is related to qualified.

To determine the amount of his plan contribution Joe must use the reduced plan contribution rate considering the plan contribution rate of 10 of 90909 from the rate table in Pub. Click the Customize button above to learn more. Federal Income Tax Withheld.

The CO Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in COS. A Roth 401k gives you a similar tax me once advantage except that you get taxed at the beginning rather than the end. Please note that this calculator is only intended for sole proprietors or LLCs taxed as such.

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. The Solo 401k is a retirement account and is tax-deferred therefore there is no tax return due for a Solo 401k plan. Withdrawing an amount less than what is allowable as a medical expense deduction.

The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. The Colorado income tax calculator is designed to provide a salary example with salary deductions made in Colorado. The cpi calculator consumer price index calculator exactly as you see it above is 100 free for you to use.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Your 401k plan account might be your best tool for creating a secure retirement. If your total itemized deductions are less than the standard deduction the calculator will use the standard deduction.

If your business is an S-corp C-corp or LLC taxed as such please consult with your tax professional. The IRC Section 164f deduction which in this case is ½ of his SE tax 14130 x ½. Plus many employers provide matching contributions.

The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. You get a tax deduction essentially letting you deposit pre-tax dollars. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

If you have less than 250000 in your 401k plan nothing needs to be filed. Elective salary deferrals are excluded from the employees taxable income except for designated Roth deferrals. Pre-tax Deduction Rate Annual Max Prior YTD CP.

With a solo 401k you are allowed to make contributions in the role of employee and the role of. Open Solo 401k Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. The sharpe ratio calculator exactly as you see it above is 100 free for you to use.

Marriage has significant financial implications for the individuals involved including its impact on taxation.

Customizable 401k Calculator And Retirement Analysis Template

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Microsoft Apps

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Retirement Services 401 K Calculator

401k Contribution Calculator Step By Step Guide With Examples

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

What Is A 401 K Match Onplane Financial Advisors

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Contribution Calculator Step By Step Guide With Examples

401k Calculator For Excel 401k Calculator Savings Calculator Spreadsheet Template

Free 401k Calculator For Excel Calculate Your 401k Savings

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

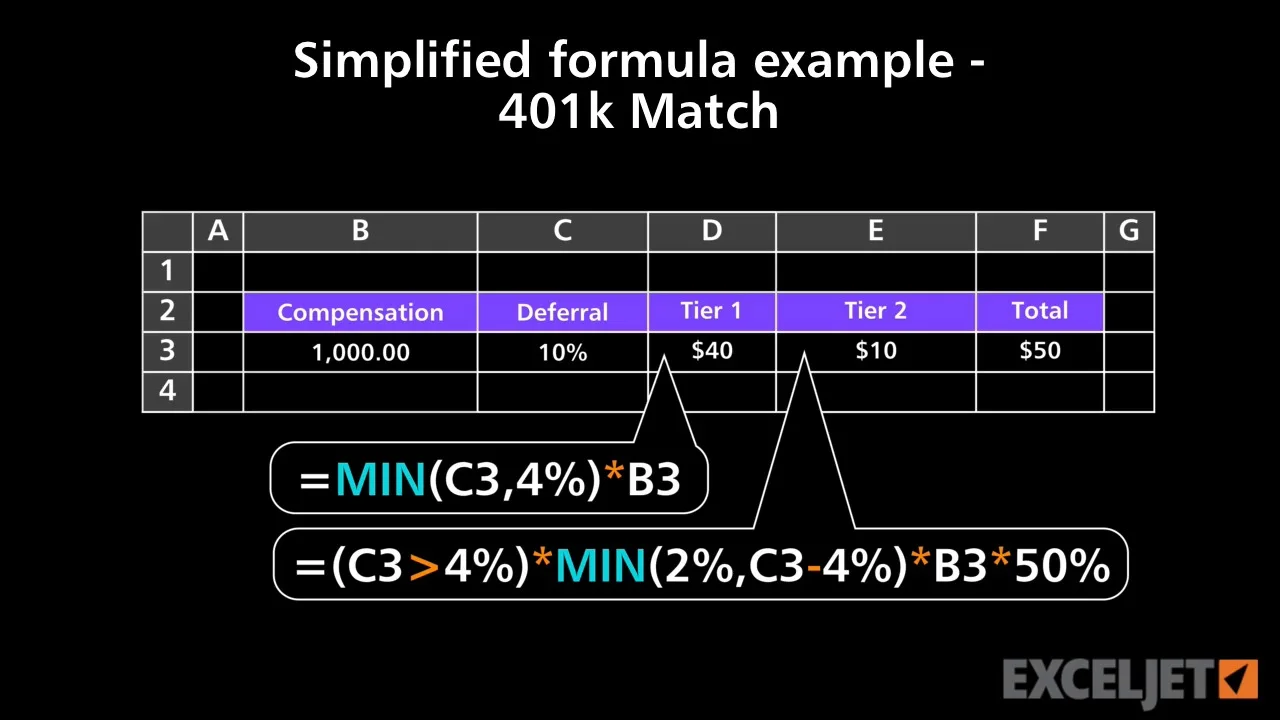

Excel Tutorial Simplified Formula Example 401k Match

How Much Can I Contribute To My Self Employed 401k Plan

401k Calculator